Meriaura Group

0.045 EUR -1.74%Meriaura Group has two business areas: Maritime Logistics and Renewable Energy. Meriaura transports dry cargo and executes demanding project deliveries in Northern Europe. The company offers CO2 reducing marine transport services based on the use of recycled, in-house produced bio-oil. Meriaura Energy designs and delivers clean energy production solutions for district heating and industrial use worldwide, with Europe as the main market area.

Log in to see the recommendation and risk by Inderes

Latest research

Extensive report

Analyst

Financial calendar

Major OwnersSource: Millistream Market Data AB

| Owner | Capital | Votes |

|---|---|---|

| Meriaura Invest Oy | 61.2 % | 61.2 % |

| Hybrid Consulting Oy | 3.9 % | 3.9 % |

Premium

This content is for our Premium customers only.

Insider Transactions

| Insider | Date | Total value |

|---|---|---|

| Repo Eljas | 30.03.2023 | 33,937SEK |

| Eero Kalevi Auranne | 27.03.2023 | 347EUR |

Premium

This content is for our Premium customers only.

Forum updates

Income statement

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 5.1 | 2.5 | 8.6 | 66.2 | 78.5 | 85.2 | 94.8 | 101.9 |

| growth-% | 49.8 % | -51.2 % | 245.8 % | 666.5 % | 18.6 % | 8.6 % | 11.2 % | 7.6 % |

| EBITDA | -3.4 | -4.2 | -3.6 | 6.3 | 8.7 | 9.8 | 11.6 | 12.7 |

| EBIT (adj.) | -3.9 | -4.6 | -3.8 | 1.0 | 3.3 | 4.2 | 5.7 | 6.6 |

| EBIT | -3.9 | -4.6 | -3.8 | 1.0 | 3.3 | 4.2 | 5.7 | 6.6 |

| Profit before taxes | -5.0 | -5.8 | -4.1 | -0.3 | 2.0 | 3.2 | 4.7 | 5.6 |

| Net income | -5.0 | -5.8 | -4.1 | -0.3 | 1.8 | 3.0 | 4.5 | 5.4 |

| EPS (adj.) | -0.08 | -0.03 | -0.01 | -0.00 | 0.00 | 0.00 | 0.01 | 0.01 |

| growth-% | 67.7 % | 48.9 % | 19.6 % | |||||

| Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividend ratio |

Login required

This content is only available for logged in users

Profitability and return on capital

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| EBITDA-% | -66.6 % | -167.2 % | -41.4 % | 9.6 % | 11.1 % | 11.5 % | 12.2 % | 12.5 % |

| EBIT-% (adj.) | -76.2 % | -182.4 % | -43.6 % | 1.6 % | 4.2 % | 5.0 % | 6.0 % | 6.4 % |

| EBIT-% | -76.2 % | -182.4 % | -43.6 % | 1.6 % | 4.2 % | 5.0 % | 6.0 % | 6.4 % |

| ROE | -120.6 % | -103.4 % | -19.4 % | -0.7 % | 4.4 % | 7.0 % | 9.6 % | 10.4 % |

| ROI | -77.7 % | -76.2 % | -12.0 % | 1.8 % | 5.3 % | 6.4 % | 8.3 % | 9.0 % |

Login required

This content is only available for logged in users

Valuation

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Share price (EUR) | 0.14 | 0.05 | 0.07 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| Shares | 62.9 | 165.2 | 783.1 | 886.8 | 886.8 | 886.8 | 886.8 | 886.8 |

| Market cap | 9.0 | 7.9 | 54.8 | 43.5 | 40.1 | 40.1 | 40.1 | 40.1 |

| Enterprise value | 7.0 | 4.1 | 71.5 | 56.8 | 53.4 | 52.7 | 51.2 | 48.7 |

| EV/S | 1.4 | 1.6 | 8.3 | 0.9 | 0.7 | 0.6 | 0.5 | 0.5 |

| EV/EBITDA | - | - | - | 9.0 | 6.1 | 5.4 | 4.4 | 3.8 |

| EV/EBIT (adj.) | - | - | - | 54.4 | 16.2 | 12.4 | 8.9 | 7.4 |

| EV/EBIT | - | - | - | 54.4 | 16.2 | 12.4 | 8.9 | 7.4 |

| P/E (adj.) | - | - | - | - | 22.2 | 13.3 | 8.9 | 7.4 |

| P/E | - | - | - | - | 22.2 | 13.3 | 8.9 | 7.4 |

| P/B | 1.9 | 1.2 | 1.5 | 1.1 | 1.0 | 0.9 | 0.8 | 0.7 |

| P/S | 1.8 | 3.2 | 6.3 | 0.7 | 0.5 | 0.5 | 0.4 | 0.4 |

| Dividend yield | ||||||||

| Equity ratio | 66.2 % | 79.5 % | 55.0 % | 58.9 % | 58.1 % | 59.4 % | 61.4 % | 64.6 % |

| Gearing ratio | -41.9 % | -58.8 % | 47.2 % | 33.3 % | 31.8 % | 28.1 % | 22.6 % | 15.7 % |

Login required

This content is only available for logged in users

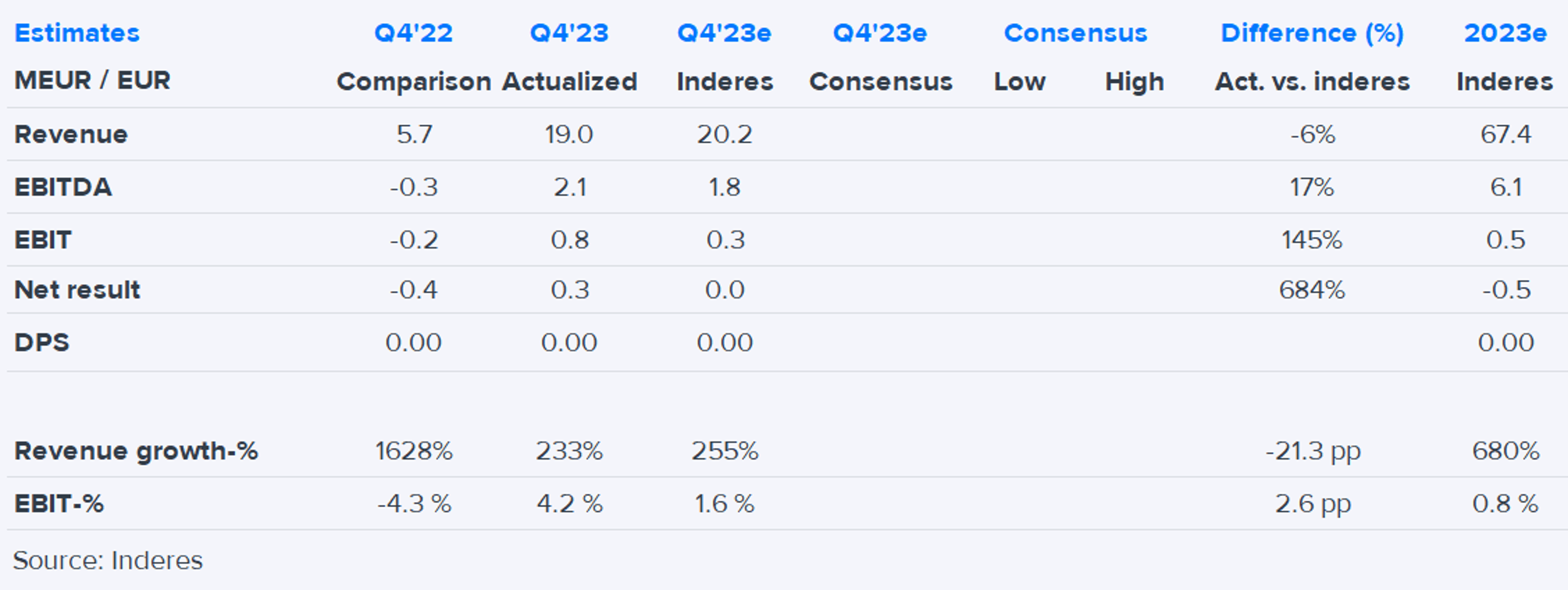

Quarter data

| Q1/23 | Q2/23 | Q3/23 | Q4/23 | 2023 | Q1/24e | Q2/24e | Q3/24e | Q4/24e | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 16.2 | 15.3 | 15.7 | 19.0 | 66.2 | 18.3 | 19.2 | 18.7 | 22.3 |

| EBITDA | 1.5 | 1.1 | 1.7 | 2.1 | 6.3 | 1.9 | 2.1 | 2.0 | 2.7 |

| EBIT | 0.2 | -0.2 | 0.3 | 0.8 | 1.0 | 0.5 | 0.7 | 0.6 | 1.5 |

| Profit before taxes | -0.1 | -0.5 | 0.0 | 0.2 | -0.3 | 0.3 | 0.4 | 0.4 | 0.9 |

| Net income | -0.1 | -0.5 | 0.0 | 0.3 | -0.3 | 0.2 | 0.4 | 0.3 | 0.9 |

Login required

This content is only available for logged in users

Small but interesting solar thermal project in France for Meriaura Group

Inside information: Meriaura Energy signs a contract with Serres Vermeil SARL to deliver a solar thermal plant in Palau-del-Vidre, France

Join Inderes community

Don't miss out - create an account and get all the possible benefits