Digital Workforce

3.39 EUR -0.29%Digital Workforce is a service provider that specializes in process automation services on an industrial scale. The company's service offering covers the entire life cycle of intelligent automation: design and consulting, development and deployment, cloud-based platform, support and maintenance, and further development. The company offers services and solutions to a wide range of customers in various industries, including finance, healthcare, industry, logistics, and various public actors.

Latest research

Extensive report

Analyst

Latest videos

Financial calendar

Major OwnersSource: Millistream Market Data AB

| Owner | Capital | Votes |

|---|---|---|

| CapMan Growth Equity Fund 2017 Ky | 15.9 % | 15.9 % |

| Heikki Länsisyrjä | 11.7 % | 11.7 % |

Premium

This content is for our Premium customers only.

Insider Transactions

| Insider | Date | Total value |

|---|---|---|

| Tuomo Olavi Sievilä | 27.12.2023 | 325EUR |

| Tuomo Sievilä | 07.06.2023 | 477EUR |

Premium

This content is for our Premium customers only.

Forum updates

Income statement

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 19.1 | 22.4 | 25.5 | 24.9 | 25.6 | 27.8 | 31.7 | 36.1 |

| growth-% | 11.3 % | 17.1 % | 13.9 % | -2.2 % | 2.9 % | 8.5 % | 13.8 % | 14.0 % |

| EBITDA | -0.4 | -1.0 | -1.7 | -0.6 | 0.7 | 1.8 | 3.9 | 5.3 |

| EBIT (adj.) | -0.6 | -0.8 | -1.3 | -0.0 | 0.6 | 1.6 | 3.7 | 4.9 |

| EBIT | -0.6 | -1.2 | -2.6 | -0.8 | 0.6 | 1.4 | 3.5 | 4.9 |

| Profit before taxes | -0.8 | -3.5 | -3.0 | -0.7 | 0.9 | 1.7 | 3.7 | 5.1 |

| Net income | -0.9 | -3.6 | -3.0 | -0.7 | 0.7 | 1.5 | 3.1 | 4.2 |

| EPS (adj.) | -1.82 | -0.25 | -0.15 | 0.01 | 0.06 | 0.14 | 0.29 | 0.38 |

| growth-% | 653.5 % | 138.2 % | 102.5 % | 28.2 % | ||||

| Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.19 |

| Dividend ratio | 50.0 % |

Login required

This content is only available for logged in users

Profitability and return on capital

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| EBITDA-% | -2.1 % | -4.3 % | -6.7 % | -2.6 % | 2.9 % | 6.6 % | 12.5 % | 14.7 % |

| EBIT-% (adj.) | -3.1 % | -3.8 % | -5.0 % | -0.2 % | 2.2 % | 5.8 % | 11.7 % | 13.5 % |

| EBIT-% | -3.1 % | -5.5 % | -10.2 % | -3.4 % | 2.2 % | 5.2 % | 11.2 % | 13.5 % |

| ROE | 454.8 % | -40.5 % | -17.8 % | -4.6 % | 4.5 % | 9.2 % | 16.9 % | 19.1 % |

| ROI | -33.9 % | -11.5 % | -13.8 % | -5.0 % | 5.2 % | 10.3 % | 19.6 % | 23.0 % |

Login required

This content is only available for logged in users

Valuation

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Share price (EUR) | 6.58 | 3.95 | 3.02 | 3.39 | 3.39 | 3.39 | 3.39 | |

| Shares | 0.5 | 11.0 | 11.2 | 11.3 | 11.3 | 11.3 | 11.3 | 11.3 |

| Market cap | 72.5 | 44.1 | 34.0 | 38.1 | 38.1 | 38.1 | 38.1 | |

| Enterprise value | 54.2 | 28.5 | 21.7 | 23.9 | 22.3 | 19.0 | 14.5 | |

| EV/S | - | 2.4 | 1.1 | 0.9 | 0.9 | 0.8 | 0.6 | 0.4 |

| EV/EBITDA | - | - | - | - | 32.2 | 12.2 | 4.8 | 2.7 |

| EV/EBIT (adj.) | - | - | - | - | 43.3 | 13.7 | 5.1 | 3.0 |

| EV/EBIT | - | - | - | - | 43.3 | 15.5 | 5.4 | 3.0 |

| P/E (adj.) | - | - | - | 375.0 | 55.9 | 23.5 | 11.6 | 9.0 |

| P/E | - | - | - | - | 55.9 | 25.7 | 12.3 | 9.0 |

| P/B | - | 4.0 | 2.9 | 2.3 | 2.5 | 2.3 | 1.9 | 1.6 |

| P/S | - | 3.2 | 1.7 | 1.4 | 1.5 | 1.4 | 1.2 | 1.1 |

| Dividend yield | 5.5 % | |||||||

| Equity ratio | -6.5 % | 69.0 % | 55.4 % | 70.8 % | 64.6 % | 65.1 % | 68.6 % | 69.8 % |

| Gearing ratio | 156.2 % | -100.0 % | -101.2 % | -83.1 % | -92.1 % | -93.6 % | -95.7 % | -97.4 % |

Login required

This content is only available for logged in users

Quarter data

| Q1/23 | Q2/23 | Q3/23 | Q4/23 | 2023 | Q1/24e | Q2/24e | Q3/24e | Q4/24e | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 12.6 | 12.3 | 24.9 | 12.4 | 13.2 | ||||

| EBITDA | 0.1 | -0.8 | -0.6 | 0.3 | 0.4 | ||||

| EBIT | 0.0 | -0.9 | -0.8 | 0.2 | 0.3 | ||||

| Profit before taxes | 0.2 | -0.9 | -0.7 | 0.4 | 0.5 | ||||

| Net income | 0.2 | -0.9 | -0.7 | 0.3 | 0.4 |

Login required

This content is only available for logged in users

Inside Information: Digital Workforce Services has received a significant order of approximately € 2.7 million from a major utility company in the United States

Resolutions of Digital Workforce Services Plc’s Annual General Meeting 2024

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

PREMIUM account

Digital Workforce: Strategy refined around strengths

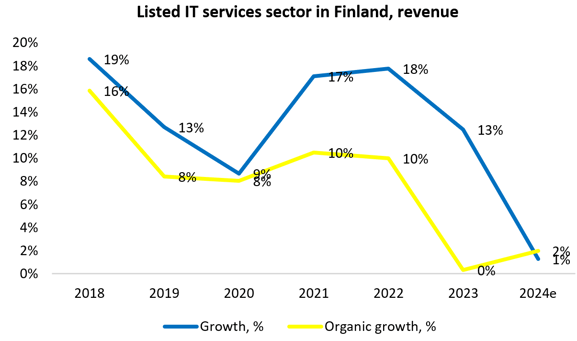

IT service sector: Our expectations for 2024 generally at the lower end of companies' guidance

Change in the Management Team of Digital Workforce Services Plc

Digital Workforce Services Plc’s Financial Statements and annual report for the year 2023 has been published

Digital Workforce Services Plc completes the acquisition of company’s own shares

Digital Workforce Services Plc: SHARE REPURCHASE 20.3.2024

Digital Workforce Services Plc: SHARE REPURCHASE 19.3.2024